Growing against the tide of the epidemic, foreign trade, "a box is difficult to find", shipping companies have made a pot of money

The COVID-19 epidemic has cast a thick cloud over the year 2020, which has hit all walks of life in the world, especially the export industry. It is even more difficult to find a box, the 10,000-dollar freight and the lottery booking.

However, the shipping industry has ushered in a sudden trend of growth, in the first half of the year quickly turned into a profit.

Shipping companies made amazing profits in the third quarter

Statistics on container trade for the first nine months of 2020 show that global seaborne trade fell by 3.4 per cent.

But given the sharp reversal in traffic over the past few months, the situation has improved.

The September figures already show a 6.9 per cent increase.

Earlier, at the start of the COVID-19 outbreak, most shipping consultants were pessimistic about global trade by 2020, and were experiencing unprecedented difficulties as the shipping industry, which has benefited from global trade growth, was hampered by the epidemic.

Industrial chains have been disrupted, freight volumes have plummeted, and more and more liners from Asia to Europe to North America have been flagged off.

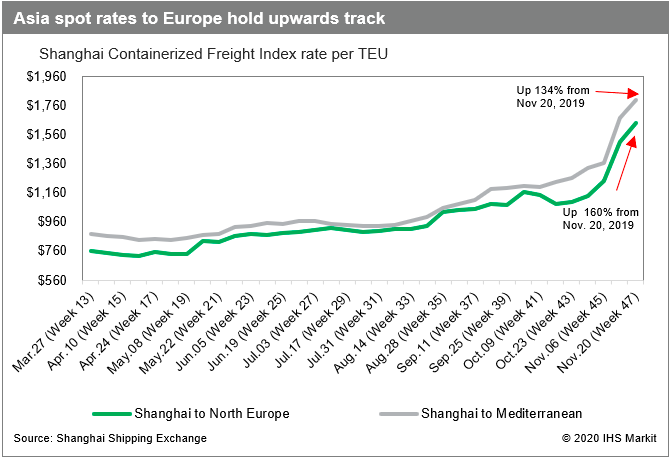

However, as the market capacity regulation, the mid-year period has seen a big reversal of the forecast, container shipping volume declined, but freight performance is much more positive than previously expected.

Despite the drop, China's container freight index is still 7.4 per cent above its level in the first half of 2019.

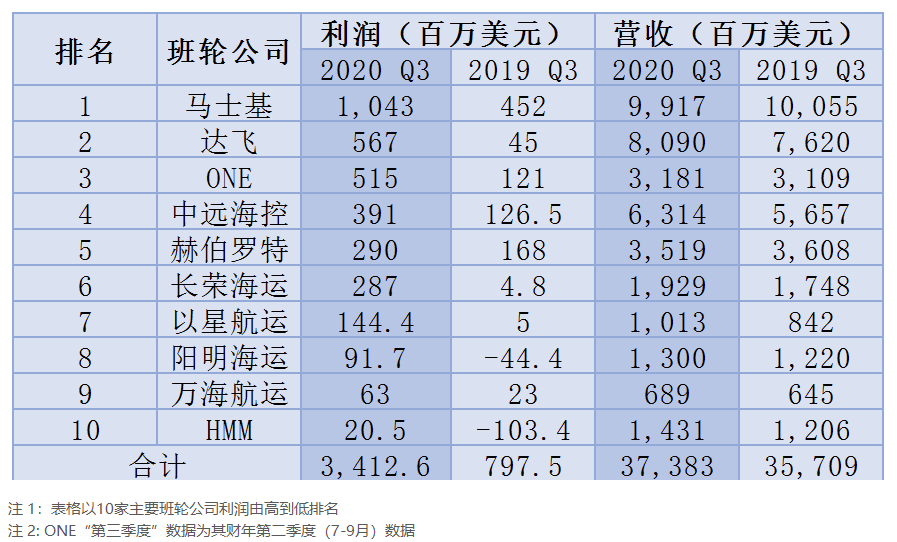

By sorting out the performance of each shipping company, the revenue of the world's 10 major shipping companies in the third quarter of 2020 was still higher than that of the same period last year.

All 10 shipping companies were profitable in the third quarter, with a combined profit of $3.412bn, up from less than $800m in the same period last year and 4.27 times that in the same period last year.

Maersk was the biggest, with a profit of $1.043bn in the third quarter and the only shipping company to make a profit of $1bn.

Maersk expects full-year earnings of $8 billion to $8.5 billion.

Evergreen Marine had the biggest profit increase, with a staggering increase of nearly 60 times year-on-year.

And 2020 is on track to be Evergreen's best year in a decade.

In addition, other shipping companies have also made outstanding achievements.

Among them, star Shipping in the third quarter performance growth reached 28 times, net profit increased by 2,818.4 percent.

Who would have thought that the company was once on the verge of bankruptcy.

More importantly, IXING shipping has seized the opportunity of the e-commerce market and opened several e-commerce routes this year, which has greatly improved its performance.

In addition, Yangming lost more than $27m in the first quarter and $2.25m in the second, and finally turned a profit in the third quarter, the first in more than two years, as ocean freight rates soared.

Finally, Hyundai has stabilized its profitability.

Hyundai, which ended 21 consecutive quarters of losses in the second quarter of this year, was divided over whether it could sustain a profit in the third quarter.

In the third quarter of this year, hyundai's revenues were $1.43bn, up 18.7 per cent from a year earlier.

During the period, the volume was 1.04 million TEU, slightly lower than the 1.07 million TEU in the same period last year.

On the whole, under the condition of basically stable operating income, all big ship companies have made profits several times or even dozens of times compared with the same period last year, which can be described as making a lot of money.

Full-year profits are expected to be $14bn

In fact, in the early stage of the outbreak, countries around the world have been blockades, coupled with temporary chaos in the import and export supply chain, consumer consumption expectations have plummeted, stopping more capacity may indeed be the last resort of shipping companies to "cut the bleeding arm".

But it didn't take long for shipping companies to figure out that not only could they save on operating costs, but they could also make a lot of money out of it.

As the world's largest economies move from initial shock to active "self-help", the market recovery is not as weak as one might expect.

China and foreign countries outbreak peak "time lag" to the shipping market of great wheezing, epidemic prevention policies and strict, and the other side of the relatively loose market to boost the economy, plus the shipping industry in the delivery of epidemic prevention and daily necessities are irreplaceable importance, the ship less, but demand is still there, freight from now on to sit on the roller coaster soared, ship company profits soar thereby.

But as inventories around the world have been depleted and demand gaps have opened up, shipping has rushed to regroup and redeploy much of the spare capacity.

China was the first country in the world to respond quickly and effectively to the outbreak and bring it under control. It soon began to produce and export goods to all parts of the world.

So, all of a sudden, the demand for transportation is up.

Burst the warehouse, the lack of boxes, there is a high price of freight appeared constantly, even a freight a day.

Shipping companies within a few months back to a year of losing, and even a few years of revenge.

Even some shipping companies said that even a sharp fall in second-half profits would not be enough to change the full-year results.

Drewry lifted its 2020 container-shipping profit forecast by 16 per cent to $11bn after strong third-quarter results.

Sea-intelligence is more optimistic, forecasting full-year profits of $14bn.

This is a level not seen since 2010.

The shipping industry remains optimistic in 2021

Some big shipping companies, such as Maersk and Haberot, also raised their full-year earnings forecasts after the third quarter ended.Cma also said the market would remain strong for the rest of the year.

While most shipping companies remain cautious about the market outlook for next year, Delury said they are optimistic about 2021 despite a second wave of outbreaks.

"Whether 2021 can match or exceed this year's performance depends on a number of factors, but some data related to contract rates suggest that the consolidation sector should be able to make a decent profit."Delury analysis said.

Sea-intelligence believes that there is still a great deal of uncertainty in the market as a result of the outbreak, and that as supply chain bottlenecks are resolved, the freight rates, which continue to hit record highs, will gradually weaken.

"Hopefully the market will stabilize and 2021 May not be as profitable."

But sea-Intelligence adds that shippers have created an advantage this year through strict capacity management, and with only a limited number of new ships to be built in 2021, profits are expected to remain high next year if companies continue to adhere to "capacity discipline".